The Big Beautiful (Budget) Bill is predicted to cause the largest ever shift in income from the lower and middle income categories to the higher income categories. It will drive the Plague of Inequality.

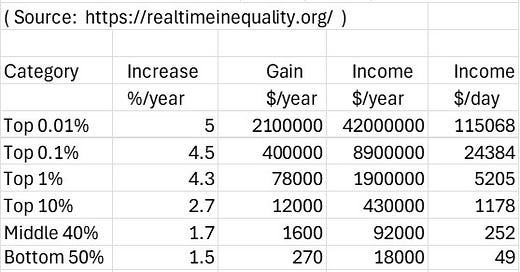

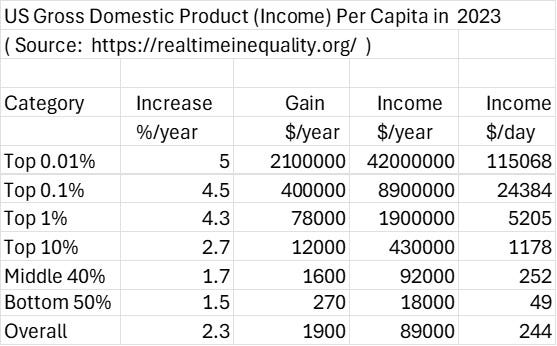

So, where is it at now? In 2023, after the Biden Administration had brought the economy back on-line after the devastation in place in 2020 at the end of the previous Trump Administration, it looked like the following, all numbers per capita, i.e., per person for every person in the US population:

Notice the overall average is $244/person/day. The bottom 50% were at $49/day and the top 0.01% at $115,068/person/day. Comparable figures in the same year for All Travelers on the Spaceship Earth is $36/person/day (see World Bank Estimates ). So, with the US under the Biden Administration averaging $244 — well, no wonder the World Bank was praising the Biden Economy as the best economy on the Spaceship.

Big Beautiful Bill Guarantees Economic Inefficiency

What is coming with the Trump Administration and the Big Beautiful Bill? Only time will tell, but predications are dire. And, does it matter? Well, yes, as Metaeconomics makes clear, not paying adequate attention to the Ethic of Inequality and focusing only on Incentive ensures economic inefficiency.

Inefficiency here we come.

Great Thinkers Agree

And, if you doubt that Extreme Inequality is a problem, go read what some of the greatest thinkers have said, and warned us about. Williams (2024) points to the downside of Extreme Inequality as recognized by some of the greatest thinkers that every Traveled on the Spaceship, including Plato; Jesus (along with brother Peter and Paul); Thomas Hobbes; Jean-Jacque Rousseau; Adam Smith; John Stuart Mill; and Karl Marx. Extreme Equality leads to the Plague of Inequality that destroys both Economy & Society.

Notice that not only Christian framing by Jesus et al in the New Testament but also Adam Smith the first economist both see it essentially the same way. Extreme Inequality destroys the system.

Optimal Inequality Works

The Plague can only be avoided with moving toward Optimal Inequality. The Ethic of Inequality must temper the Incentive of extreme inequality. See Optimal Inequality, as defined by Metaeconomics.

And, With Some Help From ChatGPT, the Supposed Fraud, on the Supposed Waste and Taking at the Lower End of the Income Spectrum

My Framing and Questions:

The "Big Beautiful (Budget) Bill" seems to be premised on fraud, waste and taking by lower and middle income people, as though the higher income people (who will benefit greatly by the Bill) are more deserving, and, apparently presumed more ethical as well as meritorious. So, how about the fraud, waste, and taking by higher income people? What does the science say about fraud, waste and taking across the income and wealth spectrum? What is the (science, fact-based) reality about fraud, waste, and taking by people over the entire income and wealth ladder?

ChatGPT said:

Your question raises a critical point about the double standard often present in political and policy rhetoric, especially surrounding welfare, tax policy, and public spending. The notion that fraud, waste, and "taking" are predominantly problems of the poor is not only empirically flawed, but also ideologically loaded. Let’s unpack what the science and evidence show across the income and wealth spectrum.

🔍 What the Research Shows: Fraud, Waste, and Taking by Income and Wealth Level

1. Low- and Middle-Income Individuals: Welfare Fraud and Misuse

Prevalence: Studies consistently show that fraud in welfare programs (like SNAP, Medicaid, TANF) is relatively low, typically estimated at less than 2–3%.

Example: SNAP fraud rates are around 1.5%, per USDA audits.

Motivations: Often driven by need and desperation, not malicious intent. Errors are frequently administrative, not intentional deception.

Oversight: These programs have high levels of surveillance, including means testing, documentation, and audits—more stringent than many corporate or tax programs.

2. High-Income Individuals and Corporations: Tax Avoidance, Regulatory Evasion, and Rent-Seeking

✅ Tax Avoidance and Evasion

Magnitude:

The top 1% of earners are responsible for over 27% of unpaid federal income taxes, according to a 2021 National Bureau of Economic Research (NBER) study.

The tax gap (difference between taxes owed and paid) is estimated by the IRS to be $600+ billion annually.

Mechanisms:

Use of offshore tax havens, pass-through entities, and complex accounting strategies.

Aggressive legal tax avoidance often borders on ethically questionable or illegal evasion.

✅ Corporate Welfare and Subsidies

Corporations receive hundreds of billions in direct subsidies, tax breaks, and favorable regulation.

Often justified as “investment,” but many of these subsidies are not tied to performance or public benefit.

"Too big to fail" bailouts, defense contracting overruns, and infrastructure privatization schemes often reflect waste and rent-seeking, benefiting the already wealthy.

✅ White-Collar Crime

Far more costly than street-level crime.

Estimated at $300–600 billion per year, dwarfing retail theft and welfare fraud combined.

Examples: Enron, Wells Fargo fake accounts scandal, opioid manufacturer Purdue Pharma.

📊 Comparative Summary Table

CategoryLow/Middle-Income FraudHigh-Income/Corporate FraudTypeWelfare fraud, benefit overclaimsTax evasion, regulatory capture, subsidiesEstimated Scale<3% of program budgetsHundreds of billions in losses annuallyMotivationNeed-driven, survivalProfit-maximization, greed, powerOversightStrict, means-testedLoopholes, weak enforcementPublic Perception (Misguided)"Lazy takers""Job creators"Actual Cost to SocietyRelatively smallSystemic, distorts markets and democracy

📚 Theoretical & Empirical Foundations

Behavioral Economics: High-income individuals and executives are more likely to justify unethical behavior when given ambiguous rules or weak enforcement, per research by Dan Ariely and others.

Dual Interest Theory in Metaeconomics: The unchecked pursuit of ego-based self-interest (e.g., rent-seeking, regulatory arbitrage) without tempering by shared other-interest (social norms, ethical governance) leads to economic dysfunction.

Sociology and Criminology: White-collar crime often goes underpunished due to social status, access to legal defense, and political influence.

Political Economy (e.g., Stiglitz, Piketty): Systems of tax and policy design are structurally tilted to favor the wealthy, enabling legalized forms of "taking" through regressive taxation and captured institutions.

🧠 Bottom Line: A False Moral Hierarchy

The idea that wealthier individuals are more ethical, meritorious, or less prone to fraud is not supported by evidence. In fact:

The means and opportunities for large-scale fraud increase with wealth and complexity.

Moral licensing and elite impunity help perpetuate higher-level abuses of the system.

Much of the policy discourse is shaped by elite narratives that scapegoat the poor while ignoring or excusing elite "taking."

Could not have said it better myself!

Reference

Williams, David Lay. The Greatest of All Plagues: How Economic Inequality Shaped Political Thought from Plato to Marx. 2024. Princeton, NJ: Princeton University Press.